15th Bled Electronic Commerce Conference

eReality: Constructing the eEconomy

Bled, Slovenia, June 17 - 19, 2002

Factors Affecting the Successful Introduction of

Mobile Payment Systems

Hans van der Heijden

Vrije Universiteit Amsterdam, Faculty of Economics and Business Administration,

The Netherlands

HHeijden@feweb.vu.nl

Abstract

A prerequisite to carry out transactions using a mobile phone is an effective mobile

payment system. However, no standardised, widely adopted mobile payment system

has yet emerged, and this is believed to be one of the factors that inhibits

widespread use of mobile commerce. This paper reports on a research project in

which the factors are examined that affect the introduction success of mobile

payment systems.

We start from the venture point that a lot can be learned from research on internet

paying systems, payment systems that have been introduced to faciliate payments

made over the internet. First we transferred factors affecting the introduction of

internet payment systems to a mobile setting. We then contrasted this list with the

views of 13 executives we interviewed in Sweden and the Netherlands.

We found that while many factors are at play at the same time, a subset of these

stood out at the early stages of the lifecycle of mobile payment systems. In the area

of consumer acceptance, these are their cost and their ease of use relative to other

payment methods, and the perceived risk. In the area of merchant acceptance,

transaction fees compared to debit and credit card systems are important, as is, to a

significant extent, the ease of use for the merchant. Finally, both customer and

merchant acceptance are highly interdependent as each influences the other,

especially during the early stages.

1. Introduction

Given the sheer number of mobile phones around today, it is no surprise that the

notion has been gaining ground that the phone can also be effectively used as a

transactional device. In particular the telecommunications industry, looking for

ways to increase revenue in unsettling times, firmly pursues the options available to

allow consumers to pay for products and services using their mobile phones

(Dornan 2001).

A prerequisite to carry out transactions using a mobile phone is an effective mobile

payment system. However, no standardised, widely adopted mobile payment

system has yet emerged, and this is believed to be one of the factors that inhibits

widespread use of mobile commerce (Carlsson 2001; Kruger 2001). In one panel at

last year’s Bled conference, it was argued that “without standardised mobile

payment solutions, the traditional problems of failure to complete transactions

which are so prevalent in web-based EC would apply to mobile commerce as well”

(Hampe & Swatman, 2001, p. 63).

This paper reports on a research project that examined the factors that affect the

early implementation success of mobile payment systems. Mobile payments (or mpayments)

are defined as payments that are carried out via the mobile phone

(Kruger 2001). We define a mobile payment system, in line with Shon &

Swatman’s definition of an internet payment system (Shon and Swatman 1997), as

“any conventional or new payment system which enables financial transactions to

be made securely from one organisation or individual to another over a mobile

network”.

Relatively little has been published on the factors that affect the introduction of

mobile payment systems (see Kruger, 2001 for an exception). No doubt this can be

attributed to the sheer novelty of these systems, and the turbulent markets that these

systems have been facing since their market introduction. All of this makes it

difficult to observe and study them at this point in time. To overcome this issue we

have started from the venture point that a lot can be learned from research on

internet paying systems, payment systems that have been introduced to facilitate

payments made over the internet. Specifically, our approach has been the following.

First we transferred factors affecting the introduction of internet payment systems to

a mobile setting. We then contrasted this framework with the views of 13

executives we interviewed in Sweden and the Netherlands.

This paper is organised as follows. The next section will introduce mobile payment

systems in more detail and discuss their structure, the market players, and several

examples. We then focus on previous work related to factors affecting the

successful introduction of mobile payment systems. In particular, we examine the

literature that discusses electronic payment systems in general. Section 4 describes

the design of our empirical research in more detail. In section 5, we contrast the

results of the empirical study with the literature. The last section presents some

conclusions and directions for further research.

Factors Affecting the Successful Introduction of Mobile Payment Systems

432

2. Mobile Payment Systems

Although the implementation details of different mobile payment systems vary,

their structure is quite similar (Kruger, 2001, Figure 1). First, a customer and a

merchant agree on a transaction and either one of them notifies the mobile payment

service provider. The mobile payment service provider confirms the transaction to

customer via his/her mobile phone and then asks the customer for approval. Once

approved, the provider administers the transaction and stores the appropriate fund

transfer instructions. Periodically, these payment instructions are cleared, resulting

in net payment instructions. Settlement can take place in a variety of ways. On the

merchant’s side, it is usually the bank account which is updated. On the customer’s

side, one of a prepaid account, a bank account or a credit card account is updated.

Also, in many payment systems a monthly bill is sent, similar to the monthly phone

bill.

Figure 1: The Structure of Mobile Payments (adapted from (Kruger 2001), p. 15)

In a typical retail environment, it is the terminal at the point of sale who calls the

provider. The provider then notifies the customer by calling his or her mobile

phone. Approval takes place by entering a PIN-code. Some mobile payment

systems do not require PIN-code approval for small payments. In that case, just

pressing one button on the mobile phone is sufficient.

A notable difference between a mobile payment system and other electronic

payment systems is the identification of the customer (and the merchant). In a

mobile payment system, this identification is the GSM phone number. In other

systems it is either the bank account number, or an interim account. The implication

is that one can send funds to and retrieve funds from a phone number, rather than

the bank account. This is similar to payment systems that rely on the customer’s email

address as the prime identifier (e.g. Paypal).

Because mobile payment systems encompass both the retail sector, the financial

services sector and the telecommunications sector, their introduction is usually

prepared by a consortium of market players. These players can include telcos,

resellers, banks, credit card companies, 3rd party clearing houses, hard & software

suppliers, solution integrators, retailers. Indeed, examples of consortia in almost any

conceivable combination do exist today.

In Europe, a number of mobile payment systems are competing for market share.

Table 1 lists a non-exclusive number of representative systems that are currently

operational. An up to date, detailed overview of electronic payment systems in

Europe, including mobile systems, can be found in the ePOS database, available

online at http://www.epso.jrc.es, which is maintained by the Institute for

Prospective Technological Studies in Seville, Spain.

Table 1: Representative Mobile Payment Systems in Europe

3. Previous Work on Internet Payment Systems

A number of authors have studied the factors that influence the success of an

internet payment system (Clemons, Croson et al. 1997; Shon and Swatman 1997;

Jayawardhena and Foley 1998; Bohle, Krueger et al. 2000; Turban and Brahm

2000; Turban, King et al. 2002). We will briefly discuss their work in this section.

A Delphi study carried out by (Shon and Swatman 1997) on effectiveness criteria

for internet payment systems (IPS) revealed 15 factors distributed over six types of

stakeholders: financial institutions, IPS providers, merchants, consumers, regulators

and network providers. Security and reliability was important for almost all groups.

Lower transaction costs were favoured by merchants, consumers and financial

institutions. Scalability and universality were important factors for network

providers. Flexibility was also important for merchants.

In a study of the Mondex system, an early alternative for cash in the beginning of

the 1990’s introduced by Mastercard, (Clemons, Croson et al. 1997) consider the

They argue that the issues are Factors Affecting the Successful Introduction of Mobile Payment Systems not “simply whether benefits from the product will exceed the costs of its creation assuming that it is adopted, but rather issues of channel coordination, consumer

acceptance, and merchant acceptance. The feasibility of the initial business case

rests on gaining a critical mass of consumer and merchant acceptance” (p. 256).

Critical mass is closely related to the universality requirement, as an important

indication of critical mass is how universally available the payment system is. Poon

& Chau (2001) studied the e-payment system Octopus, an alternative for Mondex,

and also concluded that critical mass (which they term network goods leverage) and

standardisation are important requirements for the success of any new payment

system.

Jayawardhena & Foley conclude that there are three types of requirements for every

internet payment system (Jayawardhena and Foley 1998). The degree to which an

internet payment system can meet these requirements determines its success. There

are requirements related to the transaction itself (1), to the security of the

transaction (2), and other requirements (3). Transaction requirements include cost,

flexibility, ease of use, fungibility (exchangeability), and universality of the payment

system. Security requirements include privacy, anonymity, trustworthiness, and the

extent to which the payment system is backed up by a regulatory framework. Other

requirements include transferability of value, integration with back end systems,

unobtrusiveness, scalability, remote access, functionality, and user support.

In a study of the strategic issues surrounding electronic payment systems, Bohle et

al (2000) identify four issues that are related to „the demands of different actors

who shape and constrain the corridor of future retail payment systems“ (p. 2). These

are regulation (1), standardisation and interoperability (2), consumer protection,

anonymity, privacy and security (3), and integration of payments into online

transactions (4).

Finally, Turban et al. list a number of crucial factors that determine whether an

internet payment system will achieve widespread acceptance (Turban, King et al.

2002). These are independence, interoperability and portability, security,

anonymity, divisibility, ease of use, and transaction fees. Independence refers to the

degree to which the system requires specialised hardware and software.

Interoperability refers to the degree to which the system can integrate with backend

systems. E-Payment systems should minimise the risk run by buyer and seller

(security) and not disclose information that trails a buyer to the transaction

(anonymity). Divisibility refers to the spectrum of transaction amounts that a

system supports, and ease of use to the degree of effort associated with making the

transaction. A final factor that influences the acceptance of electronic payment

systems is the amount of transaction fee charged to the merchant and/or to the

consumer.

In Table 2 we have tried to synthesize these studies and arrive at a common set of

factors that could influence the success of electronic payment systems. These

factors provide the preliminary set of factors that influence the success of mobile

payment systems.

Table 2: Preliminary set of factors influencing the success of mobile payment

systems

4. Study Design

In order to get a better grip on the set of factors that affect the success of mobile

payment systems, we decided to carry out an empirical study. The subjects of our

study were executives who were directly responsible for the introduction of mobile

payment systems. The interview research method was selected because we felt that

a rich, qualitative response would provide more insight than relatively standardised

survey responses.

Eventually, we decided to conduct interviews with executives in one of the leading

Scandinavian regions on mobile commerce: Stockholm, Sweden (in particular the

Kista area). The market penetration of mobile phones in Scandinavia is very high if

not the highest in Europe. Because of this, many international companies have set

up mobile and wireless competence centers in Stockholm and Helsinki to

experiment with new mobile services (Kviselius 2001). Also, there are at least two

mobile payment systems fully operational in the Stockholm area, so we could

benefit from the experience that was gained during the introduction of these

systems.

Table 3 lists details about the interviews that were carried out in Stockholm. All the

interviews took place in Winter 2001.

Table 3: Interviews held in Stockholm

Each of the interviews had the following structure. First, we introduced ourselves

and explained the nature of our study. We then continued by explaining in brief the

factors as identified in the previous section. The interviewees then explained their

role in the mobile payment market and we continued by discussing each factor in

greater detail. Also, we asked the interviewee whether he or she had encountered

any specific bottle-necks or drivers of success that we had failed to identify so far.

To corroborate our findings, we decided to discuss the results with a number of

executives in a different region in Europe: Amsterdam, the Netherlands. Similar to

the Stockholm area, the region of Amsterdam has also an active mobile industry,

and many new companies have been set up to exploit mobile opportunities.

Confirmation or disconfirmation of the results in a different European region would

strengthen our results and give us some right to claim pan-European generalisability

(although admittedly, Stockholm and Amsterdam are not that culturally different

when compared to other European cities).

Our approach in Amsterdam was similar to the approach in Stockholm. We also had

the opportunity to invite the Dutch executives for a round table discussion, which

took place after all interviews were conducted. Table 4 lists the executives who

participated in the interviews and the round-table discussion in Amsterdam, which

also took place in the Winter of 2001.

Table 4: Interviews Held in Amsterdam

In the following section we will convey the results of our empirical study and link

these results to the previous work from section 3.

5. Discussion

Rather than exposing the responses for each interview session individually, we have

summarised and synthesised the various results in a number of key findings. Our

overall finding was that the market players were skeptical, sometimes even cynical

about the succesful introduction of mobile payment solutions. Certainly, there were

no signs of massive take-up in both countries. This may well be a sign of the times,

because in Winter 2001 the situation for the mobile industry looked particularly

gloomy. For example, one interviewee explained that his company had participated

in mobile payment experiments in multiple countries and with multiple participants.

Neither of these had been very succesful and because of this he advised us to go

back home and conduct another, more promising research project. While not every

interviewee took this pessimistic stance, the general feeling was similar.

Of course, what was and still is interesting to us is why mobile payment systems

had not been that succesful so far and why it was that not every participant agreed

that it would be succesful in the future. Do the factors that were identified in the

context of internet payment systems play a role, or were there other factors? The

remainder of this section deals with these questions.

We observed that a mere list of critical success factors does not fully do justice to

the fact that the introduction of a mobile payment system is a complex economic

game with multiple stakeholders. As in most markets with network externalities, the

acceptance and use of the system by one stakeholder is highly dependent on the

acceptance and use of the system by another (cf. discussion of this subject by

Shapiro & Varian, 1999). The executives argued almost unanimously that merchant

acceptance, consumer acceptance, telco acceptance, and bank acceptance were

highly interdependent requirements, and that critical mass in one area would

certainly impact critical mass in another area, and vice versa. Some of them felt like

playing on four different chess boards simultaneously, and when they moved one

chess piece on one board, various other chess pieces on the other boards would

move at the same time, in unexpected ways. It is no suprise that such a complex

management challenge, in the presence of bounded rationality, leads to 1) less then

optimal results, 2) a more than average dependence on luck, and 3) radical attempts

by the players to simplify the problem and to make it managerially tractable. Some

mobile payment systems effectively ruled out, or „by passed“, banks and telcos in

the beginning of their life cycle, because the complexities of dealing with these

market players were simply beyond what the players could bear at that stage.

Focusing on consumer and merchant acceptance and getting both of them to work at

the same time was already hard enough.

While the interviewees agreed that bottle-necks could occur on all four

„chessboards“, the merchant chessboard was particularly challenging. This had to

do, in large part, with the fact that merchants were eventually the ones who would

pay the payment system provider for their services, in a vein similar to credit card

issuers. While every effort was made to reduce or eliminate transaction fees for

consumers (such as a toll-free number to call the payment system), the merchants

were frequently ear-marked as the prime source of revenue. Many merchants of

course, are small and medium enterprises, and do not like the idea of paying for

something when there are acceptable, free substitutes such as cash around.

The executives in our interview sessions who represented large retail organisations

had a different view on this subject however. They saw mobile payment systems as

a viable alternative to the debit card and credit card systems, in particular because

mobile payment systems would charge lower transaction fees. Since the banks and

the large credit card companies have a great deal of power because of their large

customer base, merchants found it difficult to negotiate transaction fees with these

parties. By introducing mobile payment in their stores, an alternative to the debit

cards and the credit cards could be offered to consumers. As one executive said,

„we are extremely interested in anything that transfers payments cheaper than debit

and credit cards. But it has to be as fast and preferably faster.“

Another merchant acceptance issue was the ease-of-use at their side of the payment

system. The shop attendants did not always know what to do when a consumer

indicated he or she wanted to pay via the mobile phone. While initial training was

of course provided by the payment system provider, the merchants tended to forget

how to operate the system as time went by. Furthermore, there is always some

turnover in retail shops, so new employees arrived who were not aware of the

mobile payment system. Clearly, when shop merchants show anxiety in using the

system and „press the wrong buttons“, consumer confidence in the mobile payment

system is unlikely to increase. And if these consumers, early adopters so valuable in

the early stages of a new product, have a bad initial experience with the payment

service, this is simply critical. Interestingly, one payment system provider attempted

to beat this challenge by instructing his employees to systematically visit every

shop that had accepted the payment system and to pay something using the system.

This ensured that the mobile payment system was kept operational by the merchant

and that the shop attendants did not forget how to operate it.

As noted earlier, the traditional alternatives available to consumers to pay for a

product are difficult to beat. The advantages of physical cash exchange are clear: it

is simple, fast, and there is no additional cost involved. Because of this, most

mobile payment systems provide the service free to consumers, and continue to do

so because switching back to cash is very easy for all consumers. Taking a more

competitive viewpoint, one could argue that mobile payment systems compete with

cash for the consumer’s favour, and the consumer places value on one payment

system by taking into account the value offered by the „competition“. For this

reason, both cost and ease of use are typically evaluated in their relationship to

other alternatives, such as traditional cash.

The interviewees agreed that in particular the calling of a phone number (10 digits

most of the time) by either consumer or merchant to initiate the transaction was too

time-consuming and too error-prone. Alternatives to overcome the usability

problems were coming available on the market however. In particular, the

technology to „identify“ a certain mobile phone using a desk panel was deemed

promising. When the panel at the merchant desk had identified the phone, it could

call the mobile payment provider automatically with the payment information. This

would eliminate the manual calling of the phone number. A promising development

also includes the integration of mobile payment systems with loyalty cards, who can

be used at the P.O.S. to identify the customers and to call their mobile phones. At

the time this study took place (winter 2001), these technologies were still relatively

immature and were not incorporated in the mobile payment systems that were

operational.

Looking back to the preliminary set of factors identified in section 3, we can

observe that many of the factors that were identified in previous work also play

their role in mobile payment systems. The interviewees emphasized merchant

acceptance and consumer acceptance (universality), and stressed the importance of

cost (transaction fees) and ease of use for both parties. Bank acceptance or telco

acceptance were important too, but many executives (including those working for

banks and telcos) agreed that this would not be too great a problem if merchant

acceptance and consumer acceptance did materialise.

Security was emphasized, both for merchants and for consumers, but it was usually

framed in a factor that can best be described as perceived risk. Most of the

payments done through the mobile payment system are micropayments, and if for

one reason or another the transaction fails, the damage done would not be

particularly great. Many believed that the development of confidence in the mobile

payment system by taking appropriate security measures would positively affect

perceived risk.

Technological feasibility and user support, two other mentioned factors, were deemphasized

by the interviewees. We suggest this is because 1) these factors were

being treated like hygiene factors, and 2) these are issues that were largely under

their own control. User support and technological feasibility were almost taken for

granted: these are features of a mobile payment system that just have to be there.

However, when they are present, they will not by themselves contribute to

consumer and merchant acceptance – a typical characteristic of a hygiene factor.

Second, the market players were confident that they could solve any technical

irregularities by themselves. Because it is human nature to worry more about the

tasks of those beyond your control than those within your control, this may be the

reason why they did not regard these factors as critical for the acceptance of a

mobile payment system.

Independence, e.g. the degree to which specialised hardware and software needed to

be installed, was mentioned too by the interviewers (e.g. the desk panel in the

shop). One can argue however, that eventually, independence boils down to issues

of cost and ease of use. For example, the original set of factors assumed that

additional installment of hardware and software will be costly and less easy to use.

Thus, the more independent the system, the higher the acceptance. Yet, the desk

panel technology was embraced by the interviewers, and so this would appear to

conflict with our preliminary set, but in this case, the additional hardware would

actually increase ease of use.

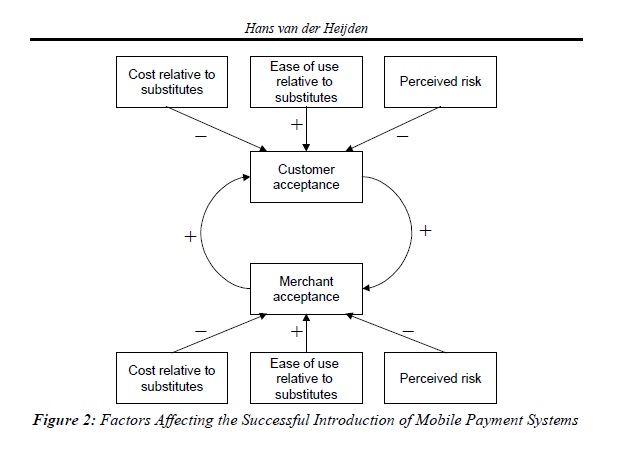

We have synthesized the critical factors for the succesful introduction of mobile

payment systems in Figure 1. In this graphical framework, we have tried to adapt

the original set of factors to what we have learned during the interview and roundtable

sessions. In summary, these enrichments are: 1) the explicit separation

between consumer and merchant acceptance, 2) the dynamics between these

stakeholders (rather than simply listing the universality factor), 3) the emphasis on

factors the interviewees deemed important, and 4) the de-emphasis of factors that

are less critical.

Figure 2: Factors Affecting the Successful Introduction of Mobile Payment Systems

6. Conclusions and Further Research

In this paper, we have conceptually and empirically investigated the factors that

affect the success of mobile payment systems. While many factors are at play at the

same time, a number of them stood out at this early stage of their lifecycle. In the

area of consumer acceptance, these are their cost relative to other payment methods,

their ease of use, and their perceived risk. In the area of merchant acceptance,

transaction fees compared to debit and credit card systems are important, as is, to a

significant extent, the ease of use for the merchant. Finally, both customer and

merchant acceptance are highly interdependent as each influences the other,

especially during the early stages of the lifecycle.

For practitioners who develop and introduce mobile payment systems, these

findings have a number of implications. First of all, we believe merchant

acceptance and consumer acceptance should be addressed and targeted seperately,

as each of these groups faces different requirements. Also, since the benefits of a

mobile payment need to be addressed relative to substitutes, areas where the relative

advantage is highest are especially attractive. These include, for instance, home

deliveries, and car parking. A third implication is that building the customer base

and the merchant base interdependently is one of the most important management

challenges to get the mobile payment system succesfully introduced.

In terms of further research, we recommend carrying out a more quantitative

oriented study, for example a survey with consumers and merchants. This would

give insight in the relative importance of each factor for the acceptance of particular

mobile payment systems. Of interest would also be the opinions of those already

exposed to a mobile payment system and those who are not, since this would give

some insight into the degree to which such a system is actually an experience good

(a good whose value can only be properly assessed after having consumed the

good). Finally, an international study would also give insight in the degree to which

consumers in different countries differ in their perception of the need for a mobile

payment system.

We agree with Hampe and Swatman (2001) that standardised mobile payment

systems are an important prerequisite for the widescale adoption of mobile

commerce services. For this reason, we offer this study to practicitioners and our

academic colleagues. We do so in the hope that it will contribute to a sharpened

focus on the critical factors affecting mobile payment solutions.

Acknowledgements

The author would like to thank Louis Kinsbergen for his support during this

research, and Menno Schilder and Coen Wartenhorst for their assistance. Thanks

also to the interviewees in Stockholm and Amsterdam for their willingness to

participate in this project, and to Pablo Valiente for his valuable comments on an

earlier draft of this paper.

References

Bohle, K., M. Krueger, et al. (2000). Electronic payment systems: strategic and

technical issues. Seville, Electronic Payment Systems Observatory (ePSO),

http://epso.jrc.es: 20.

Carlsson, C. (2001). Mobile commerce: core issues, products and services. Panel at

the Bled Electronic Commerce Conference, Bled, Slovenia.

Clemons, E. K., D. C. Croson, et al. (1997). “Reengineering money: the Mondex

stored value card and beyond.” International Journal of Electronic

Commerce 1(2): 5-31.

Dornan, A. (2001). The essential guide to wireless communications applications:

from cellular systems to WAP and m-commerce. Upper Saddle River, NJ,

Prentice Hall.

Hampe, J. F. and P. M. C. Swatman (2001). Mobile payment: opportunities,

challenges and solutions. Panel at the Bled Electronic Commerce

Conference, Bled, Slovenia.

Jayawardhena, C. and P. Foley (1998). “Overcoming constraints on electronic

commerce: Internet payment systems.” Journal of General Management

24(2): 19-35.

Kruger, M. (2001). The future of M-payments: business options and policy issues.

Seville, Electronic Payment Systems Observatory (ePSO),

http://epso.jrc.es: 29.

Kviselius, N. Z. (2001). Swedish mobile internet companies. Stockholm, Stockholm

School of Economics: 129.

Poon, S. and P. Y. K. Chau (2001). “Octopus: the growing e-payment system in

Hong Kong.” Electronic markets 11(1): 1-10.

Shapiro, C. and H. Varian (1999). Information Rules. Boston, Massachusetts,

Harvard Business School Press.

Shon, T. H. and P. M. C. Swatman (1997). Effectiveness criteria for internet

payment systems. First pacifica-asia workshop on electronic commerce,

Brisbane, Australia.

Turban, E. and J. Brahm (2000). “Smart card-based electronic card payment

systems in the transportation industry.” Journal of Organizational

Computing and Electronic Commerce 10(4): 281-293.

Turban, E., D. King, et al. (2002). Electronic commerce 2002: a managerial

perspective. Upper Saddle River, NJ, Pearson Education.

จากบทความ

Factors Affecting

the Successful Introduction of Mobile Payment

Systems

สรุปประเด็นต่อไปนี้

1.ปัญหาในงานวิจัย

ผู้ให้สัมภาษณ์บางส่วนซึ่งเกี่ยวข้องกับการการทดลองชำระเงินมือถือในหลายประเทศและมีผู้เข้าร่วมหลายรายซึ่งบริษัทเหล่านี้ไม่ได้รับการประสบความสำเร็จในการทดลองการชำระเงินผ่านระบบโทรศัพท์ทำให้มองระบบการชำระเงินในแง่ร้ายแคะคิดว่าไม่ประสบความสำเร็จ

ทำให้มองการสัมภาษณ์ในแง่ร้ายซึ่งอาจส่งผลกระทบต่อการสรุปผลการวิจัยได้

2. วัตถุประสงค์ของงานวิจัย

เพื่อศึกษาและวิจัยการดำเนินธุรกรรมทางการเงินผ่านช่องทางทางโทรศัพท์มือถือโดยเฉพาะระบบการชำระเงินผ่านโทรศัพท์มือถือว่าเป็นอย่างไร

มีปัญหาและอุปสรรคข้อดีข้อเสีย อย่างไรบ้าง รวมถึงแนวโน้มการขยายตัว

การการดำเนินการดำเนินธุรกรรมทางการเงินผ่านช่องทางทางโทรศัพท์มือถือ

3. ระบุชื่องานวิจัยที่ผู้วิจัยนำมากล่าวอ้างอิง 2

คน (ชื่องานวิจัย ชื่อเจ้าของงานวิจัย ปีที่ทำวิจัย)

1.Kruger, M. (2001). The future of M-payments:

business options and policy issues.

Seville, Electronic Payment Systems Observatory (ePSO),

http://epso.jrc.es: 29.

2. Clemons, E. K., D. C. Croson, et al. (1997).

“Reengineering money: the Mondex

stored value card and beyond.” International Journal of Electronic

Commerce 1(2): 5-31.

Dornan, A. (2001). The essential

4. วิธีการเก็บรวบรวมข้อมูล (เก็บข้อมูลจากใคร

เก็บอย่างไร)

เริ่มจากการศึกษาการดำเนินการธุรกรรมทางการเงินผ่านระบบอินเตอร์เน็ต

จากนั้นจึงนำไปสู่การดำเนินการธุรกรรมผ่านทางโทรศัพท์มือถือโดยขยายความให้ชัดเจนขึ้นผ่านทางการเก็บข้อมูลจากการสัมภาษณ์มุมมองของผู้บริหาร

13 คน ในประเทศสวีเดนและเนเธอร์แลนด์ที่มีต่อระบบการดำเนินการธุรกรรมผ่านทางโทรศัพท์มือถือ

5. ผลที่ได้จากงานวิจัย

ปัจจัยที่มีผลต่อการชำระเงินและการทำธุรกรรมผ่านระบบโทรศัพท์มือถือมีหลายอย่างได้แก่

1.

จำนวนผู้ที่จะใช้งานเกี่ยวกับการดำเนินการธุรกรรมการเงินผ่านระบบโทรศัพท์มือถือที่จะเข้ามาสู่การใช้งานระบบการดำเนินธุรกรรมการเงินและการชำระเงินผ่านระบบโทรศัพท์

2.

พื้นที่ให้บริการลูกค้า

ว่าคลอบคลุมแค่ไหนอย่างไรบ้าง

3.

ค่าใช้จ่ายหรือค่าธรรมเนียมในการดำเนินการธุรกรรมโดยผ่านระบบโทรศัพท์เมื่อเทียบกับวิธีการชำระเงินโดยวิธีอื่นๆ

4.

ความสะดวกและมีความง่ายดายในการดำเนินการแค่ไหนอย่างไร

5.

สำหรับร้านค้าค่าใช้จ่ายหรือค่าธรรมเนียมเป็นอย่างไรเมื่อเทียบกับการชำระเงินด้วยเดบิตหรือเครดิตการ์ด

สุดท้ายทั้งลูกค้าและร้านค้าจะมีการยอมรับระบบการชำระเงินและการทำธุรกรรมการเงินผ่านโทรศัพท์มือถือแค่ไหนโดยเฉพาะช่วงเริ่มแรกของการใช้งาน

สำหรับผู้ปฏิบัติงานที่พัฒนาและแนะนำระบบการชำระเงินผ่านระบบโทรศัพท์มือถือต้องมองภาพของผู้ใช้บริการในส่วนของลูกค้าและร้านค้าแยกออกจากกันตามความต้องการของแต่ละกลุ่มต่อไป

ไม่มีความคิดเห็น:

แสดงความคิดเห็น